How to Withdraw Money from Parimatch in India

Table of Content

- Parimatch India Withdrawal Process

- How to Withdraw Funds Via PariMatch Mobile App

- Withdrawal Methods Available

- Parimatch Withdrawal Time

- Minimum and Maximum Withdrawal Amounts

- How To Cancel a Withdrawal

- Parimatch India Withdrawal Problems

- Which Parimatch Withdrawal Method Is the Best?

- Concluding PariMatch Withdrawal Review

The Parimatch withdrawal process in India is straightforward and user-friendly. Users have several withdrawal methods to choose from, including bank transfer, e-wallets, and UPI, which offer a range of withdrawal options to suit different preferences and needs.

The minimum withdrawal limit for most payment methods is INR 500, which is relatively low and allows users to withdraw small amounts of funds if needed. Parimatch also offers fast withdrawal processing times, usually processing withdrawals within 24 hours of the request being made.

Drawback of the withdrawal process is the possibility of withdrawal fees and charges, which may be imposed by some payment methods or banks. Parimatch generally does not charge withdrawal fees for bank transfer withdrawals.

Parimatch India Withdrawal Process

Withdrawing money from Parimatch in India is a simple process. Here are the general steps you need to follow:

- Log in to your Parimatch account using your credentials.

- Go to the "Cashier" or "Withdrawal" section of your account.

- Select a preferred withdrawal method from the options provided.

- Enter the amount you want to withdraw.

- Follow the instructions provided by Parimatch to complete the withdrawal process.

Depending on the withdrawal method you have chosen, you may be required to provide additional information, for example, enter a PariMatch bonus code, or complete certain verification steps to complete the withdrawal process.

Once your withdrawal request is approved by Parimatch, the funds should be credited to your account within the specified time frame.

How To Verify Your Account

Verifying your Parimatch account is a simple process that involves providing the platform with some personal information to confirm your identity. Here are the general steps to verify your Parimatch account:

- Log in to your account.

- Go to the "Account Settings" or "Profile" section of your account.

- Click on the "Verify Account" or "Verification" button.

- Provide the required personal information such as your full name, date of birth, and address.

- Upload a copy of your government-issued ID, such as your passport, driver's license, or Aadhaar card, to confirm your identity.

- Upload a copy of a recent utility bill, bank statement or any other document that proves your current address.

- Submit your verification request.

Once you have submitted your verification request, the Parimatch team will review your documents and confirm your account. This process may take a few days to complete, but once your account is verified, you will have access to all of the features and functions of the platform, including depositing and withdrawing funds.

Tips to Get Verified Faster

Here are some tips that may help you get verified faster on Parimatch:

- Provide accurate and complete information: Make sure to enter your personal details correctly and provide all the required information during the verification process. This will help avoid delays due to missing or incorrect information.

- Submit clear and legible documents: When uploading your ID and address proof documents, make sure they are high-quality and legible. Avoid blurry or low-quality images, as they may be rejected and cause further delays.

- Use valid documents: Ensure that the documents you are submitting are valid and up-to-date. Expired or invalid documents will not be accepted.

- Follow instructions carefully: Parimatch may have specific instructions or guidelines for submitting your verification documents. Be sure to read and follow them carefully to avoid any mistakes or misunderstandings.

- Contact customer support if necessary: If you encounter any issues or have questions during the verification process, contact customer support at Parimatch. They may be able to provide additional guidance and help resolve any issues.

- Be patient: Verification can take some time, so be patient and wait for the Parimatch team to review and approve your documents. Avoid submitting multiple verification requests or contacting customer support excessively, as this may cause further delays.

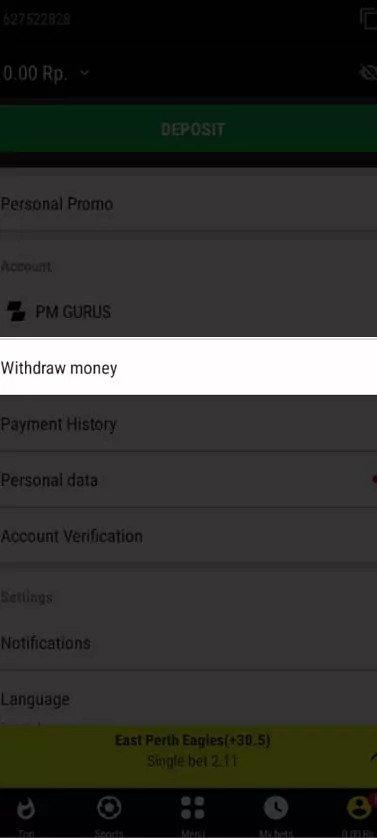

How to Withdraw Funds Via PariMatch Mobile App

Withdrawing funds from Parimatch via the mobile app is a straightforward process:

- Open the Parimatch app on your mobile device and log in to your account.

- Go to the "My Account" section and select the "Withdrawal" option.

- Choose your preferred withdrawal method from the available options.

- Enter the withdrawal amount you wish to withdraw and any additional information required, such as bank account or e-wallet details.

- Review and confirm the withdrawal request.

- Once the withdrawal request is submitted, you can track its progress in the "My Transactions" section.

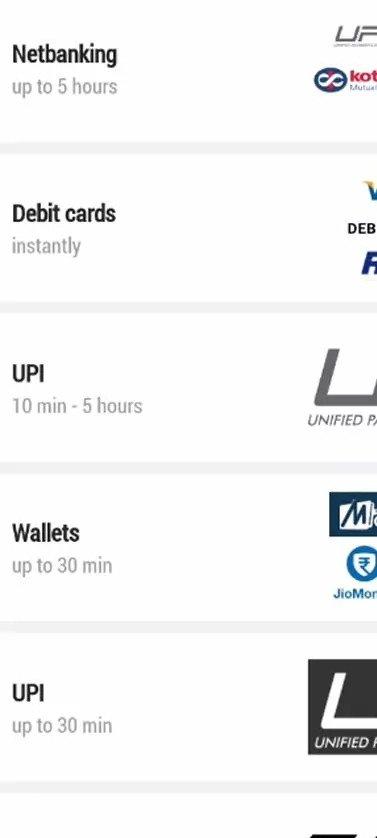

Withdrawal Methods Available

Most common withdrawal methods available at Indian casino sites:

Bank Transfer: You can withdraw funds from your Parimatch account directly to your bank account via bank transfer. This method takes 3-5 business days for the funds to reach your bank account.

Visa/Mastercard: You can withdraw funds from your Parimatch account to your Visa or Mastercard credit/debit card. This method takes 2-7 business days for the funds to be credited to your card.

Neteller: Neteller is an e-wallet service that allows you to withdraw funds from your Parimatch account to your Neteller account. This method takes up to 24 hours for the funds to be credited to your Neteller account.

Skrill: Skrill is another e-wallet service that allows you to withdraw funds from your Parimatch account to your Skrill account. This method takes up to 24 hours for the funds to be credited to your Skrill account.

Jeton: Jeton is a digital wallet service that allows you to withdraw funds from your Parimatch account to your Jeton wallet. This method takes up to 24 hours for the funds to be credited to your Jeton account.

Parimatch has certain terms and conditions related to withdrawals, such as minimum and maximum withdrawal limits, processing fees, and processing times. Make sure to review these terms carefully before initiating a withdrawal request.

Parimatch Withdrawal Time

The Parimatch India withdrawal time can vary depending on the payment method used. Here are the typical withdrawal times for different payment methods:

Bank Transfer: 3-5 business days

Visa/Mastercard: 2-7 business days

Neteller: up to 24 hours

Skrill: 24 hours

Jeton: up to 24 hours

The withdrawal time may be subject to delays due to various reasons, such as bank holidays, technical issues, or additional verification checks. Check with Parimatch's customer support team for any specific information related to withdrawal timeframes.

Minimum and Maximum Withdrawal Amounts

Typical minimum and maximum withdrawal amounts for popular payment methods:

Bank Transfer: minimum withdrawal INR 1000

Visa/Mastercard: minimum withdrawal INR 1000

Neteller: minimum withdrawal INR 500

Skrill:

minimum withdrawal INR 500

Jeton:

minimum withdrawal INR 500

The maximum withdrawal amount for each payment method can vary depending on the user's account status and transaction history.

How To Cancel a Withdrawal

If you have initiated a withdrawal request on Parimatch but wish to cancel it, you may be able to do so if the request has not yet been processed. Here are the steps you can follow to cancel it:

- Log in to your account.

- Go to the "My Account" section and select the "Withdrawal" option.

- Check the status of your withdrawal request. If it is still in "Pending" status, you may be able to cancel it.

- Click on the "Cancel" button next to the pending withdrawal request.

- Confirm that you want to cancel the withdrawal request.

If the withdrawal request has already been processed and the funds have been transferred to your bank account or e-wallet, it may not be possible to cancel it.

Parimatch India Withdrawal Problems

While this fast withdrawal casino strives to provide a smooth and hassle-free withdrawal process for its users, there may be instances where users face PariMatch withdrawal problem. Some common issues and their possible solutions are:

Account Verification Issues: Parimatch requires all users to verify their accounts before they can withdraw funds. If a user has not completed the account verification process, their withdrawal request may be delayed or rejected. To resolve this issue, users can ensure that they have submitted all the necessary documents for account verification and follow up with Parimatch customer support if necessary.

Payment Method Issues: If a user is experiencing issues with a particular withdrawal method, such as a failed transaction or incorrect details, they may need to verify the details or switch to a different withdrawal method.

Technical Glitches: Sometimes, technical issues or glitches may affect the Parimatch India withdrawal process. In such cases, users can try logging out and logging back in, clearing their cache and cookies, or using a different device or internet connection.

Anti-Money Laundering Checks: Parimatch may conduct additional checks on withdrawal requests to prevent money laundering and ensure compliance with regulatory requirements. If a user's withdrawal request is flagged for such checks, it may take longer to process.

Which Parimatch Withdrawal Method Is the Best?

The best withdrawal method depends on your personal preferences, convenience, and the available options in your country. Parimatch offers several withdrawal methods in India, including bank transfer, UPI, and it is among the best PayTM casinos in India. Each method has its advantages and disadvantages, and you should choose one that meets your needs.

For example, bank transfer is a common withdrawal method that is convenient and widely accepted but may take longer to process. UPI and Paytm are popular e-wallets in India that offer faster processing times but may have transaction fees or limits. Some users may prefer cryptocurrency withdrawals, which offer faster processing times and increased anonymity.

When choosing a Parimatch withdrawal method, consider factors such as processing times, fees, minimum and maximum withdrawal limits, security, and convenience. It is also important to review the terms and conditions of each method to understand any restrictions or requirements.

Ultimately, the best Parimatch withdrawal method is one that meets your specific needs and preferences. You can try different methods and evaluate their performance to determine which one works best for you.

Concluding PariMatch Withdrawal Review

Overall, the Parimatch withdrawal process in India is reliable and efficient, with several options available to suit different user needs. If users encounter any issues or have questions about the withdrawal process, Parimatch offers customer support to assist with any concerns or inquiries.

FAQs

Is Parimatch safe?

Parimatch is generally considered a safe and reputable online betting platform. The company has been in operation for over 20 years and has a presence in several countries, including India. Parimatch is licensed and regulated by reputable authorities, such as the Curacao eGaming Authority, which ensures that the platform operates in a fair and transparent manner. Parimatch also uses advanced security measures to protect users’ personal and financial information. The platform employs encryption technology to secure user data and transactions, and has strict policies and procedures to prevent unauthorized access or disclosure of user information.

Can I bet with INR at Parimatch?

Yes, you can bet with Indian Rupees (INR). The platform supports several currencies, including INR, and offers convenient deposit and withdrawal methods for Indian users, you can read about them in this PariMatch India withdrawal review.

Can I withdraw in currencies other than INR?

No, if you are located in India, you can only withdraw in Indian Rupees (INR) from Parimatch. Parimatch operates in various countries and offers multiple currencies for withdrawals, but the available currencies may vary depending on the country you are located in. When you withdraw from Parimatch, the funds will be converted from your Parimatch account currency to INR based on the current exchange rate. The exchange rate used for the conversion may be subject to a conversion fee, which is usually deducted by the payment provider and not by Parimatch.

What is the Parimatch maximum withdrawal limit?

The Parimatch maximum withdrawal limit varies depending on the withdrawal method you choose and the country you are located in. In India, the maximum withdrawal limit also varies depending on the payment method you use. For example, if you use bank transfer, the maximum withdrawal limit is INR 10,00,000 per transaction. However, if you use UPI, the maximum withdrawal limit is INR 2,00,000 per transaction. Paytm withdrawals have a maximum limit of INR 20,000 per transaction.

What is the Parimatch minimum withdrawal limit with NetBanking and bank transfer?

The Parimatch India withdrawal limit for NetBanking and bank transfer is INR 500.

What is the Parimatch India withdrawal time?

In general, Parimatch processes withdrawals within 24 hours after the withdrawal request has been made. However, the actual time it takes for the funds to reach your account depends on the payment method you use. If you choose to withdraw using e-wallets such as Neteller or Skrill, the funds are usually credited to your account instantly once Parimatch has processed the withdrawal request. Bank transfers may take between 1-3 business days to reflect in your account after the withdrawal has been processed. UPI and Paytm withdrawals are credited within a few hours after the withdrawal request has been processed.

Do I have to pay any withdrawal fees?

In India, Parimatch does not charge any withdrawal fees for bank transfer withdrawals. However, some e-wallets and payment methods may have their own fees and charges, which are typically deducted by the payment provider and not by Parimatch.

Top Casinos

Welcome bonus: 100% + 250 FS

Welcome bonus: 150% Up To ₹105 000

Welcome bonus: 200% + 30FS

About the Review Expert

Finance-educated online casino expert & sports content writer. 8+ years' experience. Delivers detailed evaluations aiding players in making informed gaming decisions.